For More Information Contact Us Today:

Use the Contact Form below to send us directly a message :

Abi LadeleMSc, APFS, CertPFS (DM)

Abi LadeleMSc, APFS, CertPFS (DM)

Abi started at HSBC in 2006, offering a compelling insight on a range of topics, including asset allocation, investment strategies, market dynamics and wealth management.

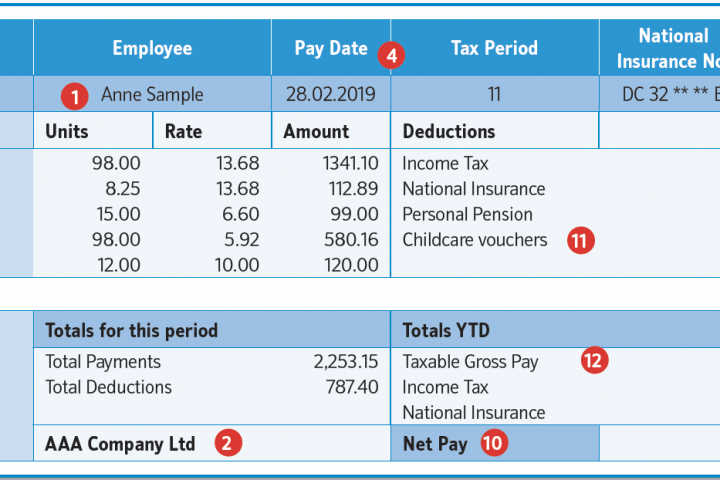

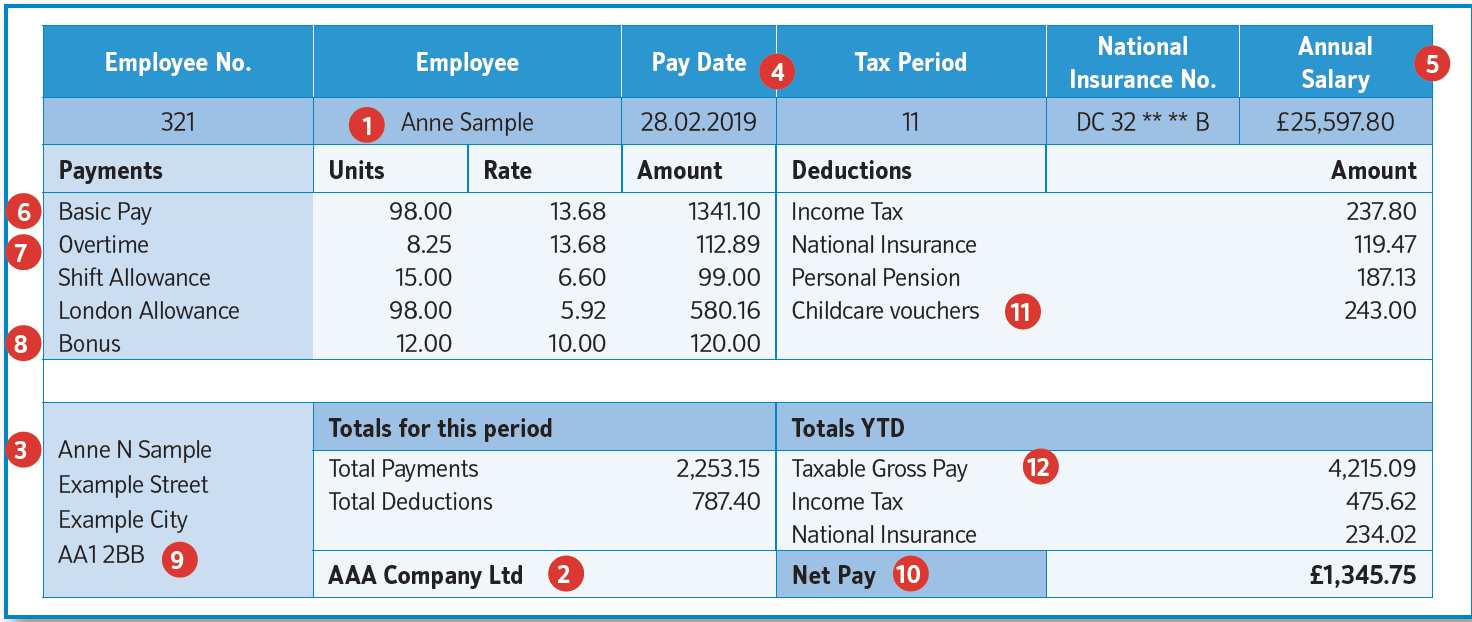

Understanding your budget is key. It's important to review your payslips and bank statements to see how much you can afford.

Understanding your budget is key. It's important to review your payslips and bank statements to see how much you can afford. Get Legal Support

Get Legal Support Ownership is passed to you. On the completion date, contracts are signed and exchanged, and funds are transferred between parties.

Ownership is passed to you. On the completion date, contracts are signed and exchanged, and funds are transferred between parties.